How to claim the tax benefits from Smashwords through email for Non US publisher?

Smashwords is one of the largest ebook distributors which distribute ebooks to all the major retailers such as Barnes & Noble, Kobo, Amazon, Apple, Inketra, Baker & Taylor Blio, Overdrive, Scribd, Yuzu, Tolino, Odilo, Gardners Library etc.,

Publishers as well as indie authors prefer to use Smashwords to publish their ebooks because they no need to have an US bank account details, no need to be an US citizen, upload ebook once and publish it everywhere, Paypal as payment type for all Non US publishers, no upfront cost,pay commissions only if book sells, no maintenance charge, provide an option to select distribution channels and finally it offers best royalties in the market.

Almost all Publishers and indie authors prefer to use Smashwords to distribute their ebooks to various distribution channels for global reach even though they do have a personal account in KDP, Createspace and Apple iBooks.

Smashwords will withhold 30% of your earning for US IRS (Internal Revenue Service) if you don’t submit W8-BEN to them. You can claim tax treaty benefits that allow you to claim partial or full exemptions from tax withholding provided if your residing county does have signed tax treaty with the US.

Your withholding rate will vary by a country where you reside. You can check out your country withholding % here.

Some of the most common countries withholding % is listed below:

Canada- 0%; United Kingdom – 0%; Canada – 0%; Australia – 5%; New Zealand – 10%;

India – 15%; South Africa – 0%;Germany – 0%.

Be sure to check the list above, because these rates are subject to change by the IRS.

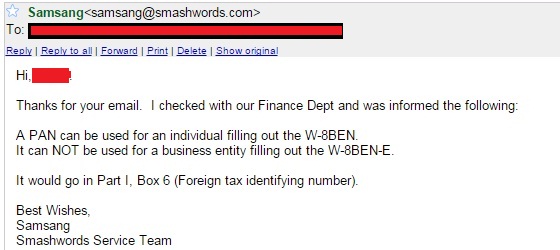

When you confirmed that your country is eligible for tax exemption then you should submit W8- BEN with your Tax Identification Number(Called as PAN in India) to avail the benefits.

You can also download W8-BEN form by clicking on the “Download” button below:

As per the instructions are given in the Smashwords, you should fill the W8- BEN form, Sign it and send via postal mail to below address:

Smashwords, Inc.

Attn: Tax Compliance Dept.

15951 Los Gatos Blvd., Suite 16

Los Gatos, CA 95032 USA

A postal charge should come around $50-$100 if you’re going to mail your W8- BEN form and as an indie author, no one will be willing to spend this much amount.

Let me tell you how to submit W8-BEN form online at free of cost.

Step 1

Go to https://www.smashwords.com and log in with your username and password. Click the Smashwords help button which is shown in the top right corner as shown below

Step 2

Say to the support team that you are going to submit W8-BEN form in digital format by specifying your country and its withholding rate. Send it.

Step 3

It’s a time to fill your W8-BEN and get scanned by a nice scanner with good resolution and save it in the form of pdf.

Step 4

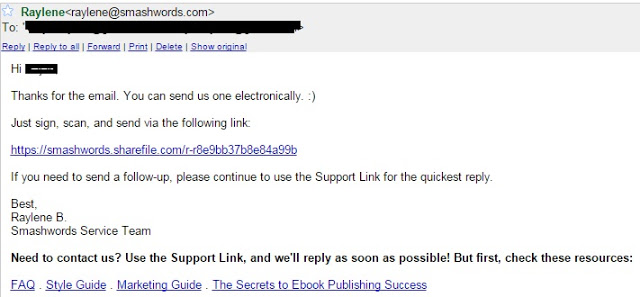

Within one or two days, you’ll receive an email from Smashwords asking you to upload your W8-BEN form through the link provided in the email.

Step 5

Navigate to the link provided in the mail and select the “Choose files” button, upload your W8- BEN form and finally click “Upload files” button. Your form will be sent to Smashwords for verification.

Step 6

Once again you’ve to contact the support team (as described in step 2) and say that you’ve uploaded your W8-BEN and ask them to confirm the same.

Step 7

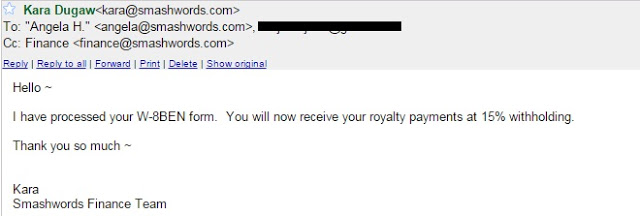

Again within one or two days, you’ll receive an email from Smashwords regarding the confirmation of your W8-BEN and changes in the Withholding %.

Step 8

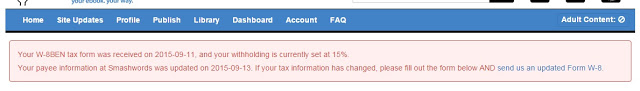

Congratulations! You’ve successfully changed the Tax withholding %. You can confirm the same from your Smashwords account as well. Go to the account tab in Smashwords and click on the “Payment settings” link at the bottom. Your new withholding rate is reflected at the top.

If you still have any doubts/Clarification then please let me know via comments.

Nice blog posting about How to claim the tax benefits in Smashwords through email for Non US publisher?………

Thanks for sharing about How to claim the tax benefits from Smashwords through email for Non US publisher………….

Thanks Vikash